Sifting through an evolving NFT industry beyond the hype culture of digital "artsets"

NFTs are "the holy grail for humans; it's just that we're the fortunate humans that are here when it's being invented…” Gary Vee

It's easy to dismiss Gary's viewpoint if you narrow his gusto about non-fungible tokens down to the $90+ million he made in his first 90 days since his foray into the arena barely three years back. Celebrities are jumping on the bandwagon and pushing a hype culture, from reality TV show hosts like Jimmy Fallon and Ellen DeGeneres to rappers like Snoop Dogg and Eminem down to sports stars like Tom Brady Grimes and Steph Curry. But my attraction to NFTs blazes past the hype culture. NFTs are more than just JPEGs; they are "artsets", as I like to call them and their use cases keep metastasising into never before imagined territories. In this article, I dived into the wild west of NFTs, covering practical use cases such as fractional NFTs, collateralising loans with non-fungible tokens, NFT index funds, carbon credits and more. Let's explore.

NFTs and art, a union made in heaven

Wikipedia defines art as a diverse range of human activity and resulting product that involves creative or imaginative talent expressive of technical proficiency, beauty, emotional power, or conceptual ideas. So art in the context of this write-up also includes music NFTs.

To take back their artistic powers, artists and creators are always looking for ways to solve authentication issues with their digital work. The problem of asserting digital ownership became history when the world realised the power of non-fungible tokens, a cryptographic asset class. While the first popular use case of NFT was a blockchain-based game called CryptoKitties, we can do more now than merely breeding digital cats in a game and flipping them for gains in ETH. NFTs have continued finding expression in different industries, ranging from sports brands like Adidas and Nike to the art industry. Auctioneers like Sotheby and Christie's are now auctioning off antique art collections as NFTs; remember the ConstitutionDAO bid? How about the AI industry? That isn’t left out either, as platforms like Human.ai, a creative studio, offer various AI tools developers can leverage to share their creations with wider audiences.

Back to NFT and art. It’s easy to equate NFTs with arts even though that’s just one of its use cases, so let's talk about the co-mingling of NFTs with art. Art is a way of preserving what fact-based historical records cannot, i.e. people’s experiences and how they felt to exist in a particular place at a specific time. For instance, through art, we can see how the wealthiest families in the Italian Renaissance era wielded power with the rarest art pieces they collected, commissioned and owned. A typical example is the Medici family of Florence during the Renaissance that commissioned plenty of art, showing their family's greatness. Today, most of these remarkable arts can only be found in the homes of wealthy collectors or museums, leaving out a vast majority from participating in ownership. But art has evolved from what it used to be in the Renaissance era to include visual technologies like photography and television with its introduction in the 20th century. The art industry has broadened access to include multi-varied expressions. But it would take the opening of the Internet to open the digital window for instant accessibility to anyone with a connection, breeding the culture of "right-click-save" or downloading from the earliest P2P networks like ThePiratesBay.

As consumers enjoyed almost unhindered access to their favourite creators' works, their counterparty grappled with extracting even the barest minimum value for their intellectual properties (IP). Because art can be viewed and duplicated digitally at zero marginal cost, creators struggled to monetise their works. With their artistic creation opened to plagiarism and mass duplication, art turned into a 'public good' project rather than a revenue spinning source from the artists' IP. Of course, these artists could easily invoke copyright laws to protect ownership; it often comes at an additional cost. Enforcing IP rights carries a financial burden that the average artist may not be able to afford, especially when defaulters are not within reach geographically. But beyond the geographical barriers, the copyright law existed to protect those with deep pockets as distribution platforms like Meta, Spotify, and YouTube have only done little to alleviate creators’ losses. After all, they are web3; the data was truly theirs and not the creators'.

Enter the blockchain!

As a credible way to authenticate digital items on the internet, the blockchain, a distributed ledger, offers what the global art market lacks —the ease of verifying authenticity and provenance. Non-fungible tokens make it possible to create unique digital or physical items by ascribing specific metadata to them, all available on-chain. Foolproofing them from the frustrating duplicity artists suffer. For instance, Alice can exchange $100 worth of BTC with Bob, who can then exchange the dollar value for the same quantity of BTC from another person assuming that the BTC price remains constant during the exchange windows. But you cannot exchange a Cryptopunk NFT for another. Each PUNK is unique and has its own identity stored on the blockchain traceable to the creator and buyers. If you’re wondering why PUNK or BAYC NFTs minted at the same time price differently, there’s your answer. NFTs are highly limited, allowing them to certify specific versions of digital items, like the one of a kind Nyan cat meme, and offer value by exploiting the concept of scarcity and subjective theory of value where items are priced not because of their inherent or intrinsic value but the emotional connection attached to them.

For creators, this provides some relief because by converting their creative works into NFTs, they can assert their ownership over works they distribute online or public domain, broadening access for maximum engagement. Today, anything can be made into an NFT, opening the doors to various new opportunities like digital estate, digital fashion and even logistics.

Let's keep going.

Beyond the 10k JPEG pfps flying around, what more can you do with your NFTs?

Before I delve deeper into NFTs and their growing utilities, I must emphasise that the word “utilities” easily gets thrown around by exuberant NFT project founders looking to cash in on the hype. Cryptokitties, the earliest example of a successful NFT project, are the pinnacle of utility for NFT projects. I mean, players breeding and selling unique digital cats were so excited about doing so that they almost brought down the Ethereum network, which could barely support such transactions volume. That, my friend, is what is called utility. Utility is the reason for a project's existence. Except for the likes of Kevin Rose and his team that recently launched the Moonbirds project, not so many of the NFTs projects flying around set out with a solid use case before or during launch. Even Bored Ape by Yuga Labs didn’t launch with a grandiose plan and concrete utility to what we see it become today. NFT project founders must understand that utility is the core reason for a project’s existence. Why should anyone mint or trade your NFT? Perhaps that will be another article entirely. Hence permit my lax use of the word utility in the context of this article. So let’s get back to NFTs beyond the hype.

If all we think of NFTs are just JPEGs, we'd have missed the revolution playing right before our very eyes. It’s no longer enough just to dole out 6 and 7 figures to acquire a pixelated or 'ugly' image to flaunt your latest avatar for the social media community. You can now exploit NFTs to accelerate your brands beyond what your look like on social media. An easy reference to point out here is the sports industry. Take the case of Adidas' partner and crypto influencer, Gmoney brandishing his pfp so flamboyantly that he even attended the physical Prada show adorned in his beanie-clad Cryptopunk pfp. Talk about extending your digital experience to physical reality; Gmoney does it well. But people are quickly getting tired of just holding an NFT to inflate their ego. If they’d hold your NFTs, then you better drum up the narrative as they are always expecting some future benefits beyond just flipping it for some quick bucks.

Extended utility

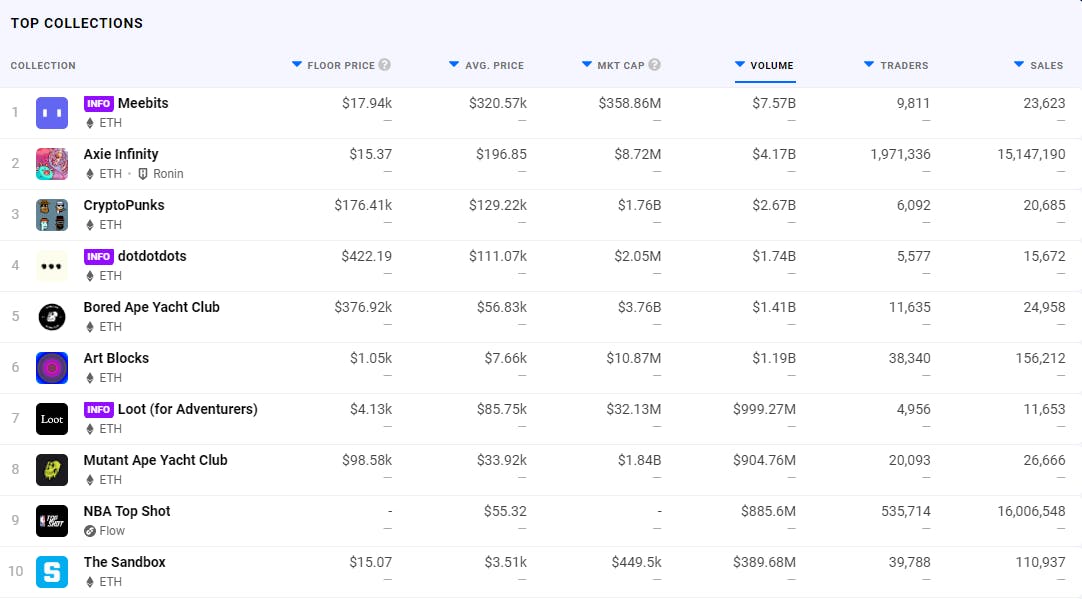

NFT projects have started incorporating utility into their NFTokenomics to meet their community’s expectations. One notable trend is rewarding early adopters or holders with a related collection to the initial NFT. For example, in May 2021, Lava Labs, the OG CryptoPunk NFT collections creators, launched Meebits, a secondary collection of 20,000 3D NFT characters and distributed about 50% of the total Meebit collection to CryptoPunk holders. Yuga Labs (which has now acquired Lava Labs), creators of the Bored Ape Yacht Club (BAYC) NFT rewarded its holders with the pet dog companions for their apes from the Bored Ape Kernel Club (BAKC). Other NFT projects like CyberKongz reward their NFT holders with the daily yield on the collection's native token. So buckle up if you’re a new founder looking to break into this interesting NFT space. Culture isn’t just about eclectic art; it’s about extended utility now more than ever.

NFT collateralisation and Index Funds

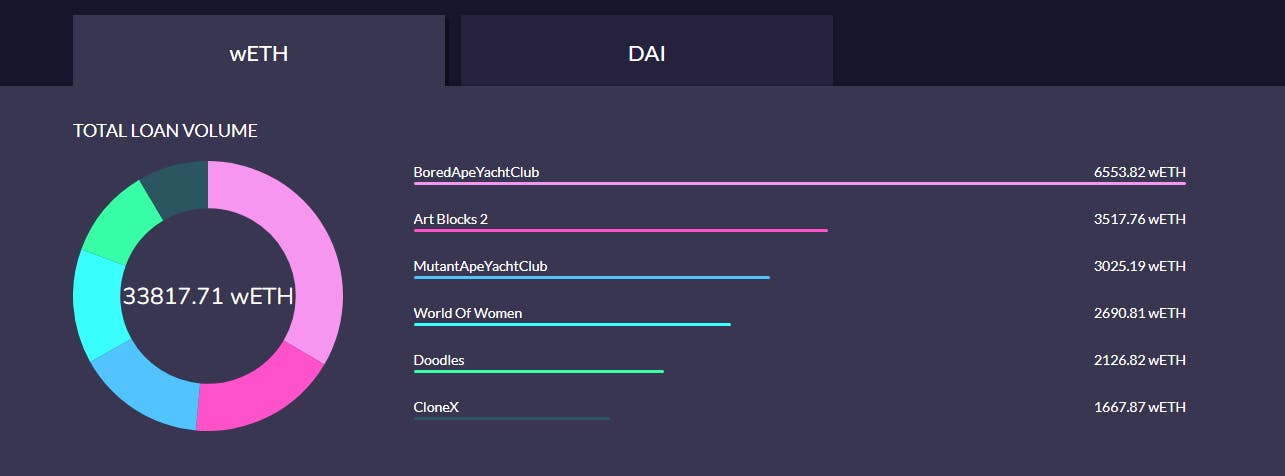

Another exciting concept around NFT utilities is loan collateralisation. Blue-chip NFTs like CryptoPunks and BAYC now see increased usage as collateral to borrow other digital assets because of their massive liquidity. NFTfi, an NFT borrowing/lending platform, allows you to borrow crypto assets by locking your NFTs on the platform as collateral. Once the loan terms are completed and repaid, you can reclaim the collateralised NFT. NFTfi currently has over $100 million in loans collateralised in wETH and over $40 million in loans collateralised in DAI. The NFT sector is evolving from an arena where millennials display cool cats pfps or Diablo playing teens into a full-fledged financial sector.

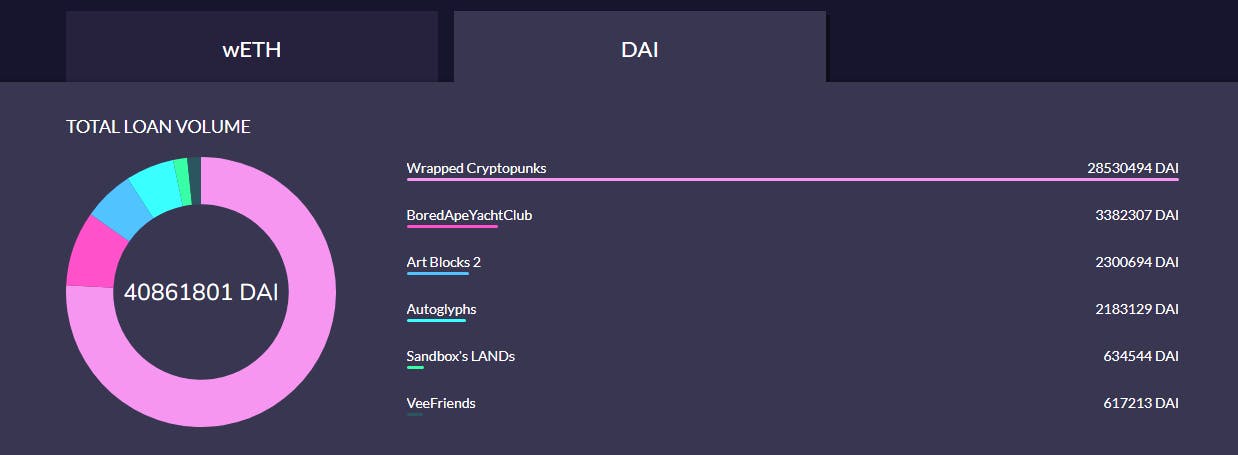

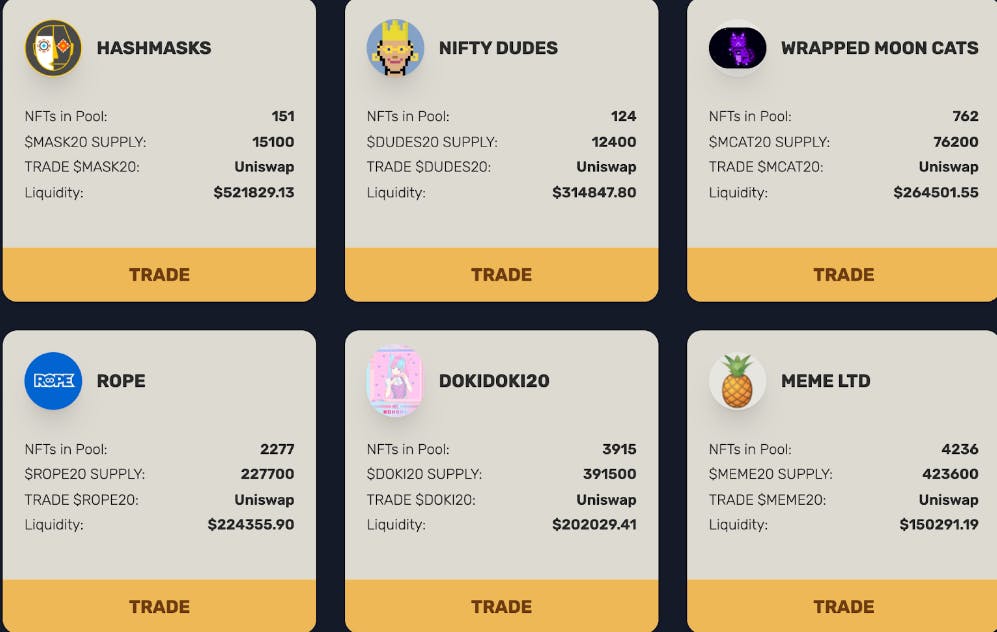

But beyond collateralisation, you can even get to extract more value from your NFT collections through NFT index funds. NFTX, an ERC-20 community-owned protocol for NFT collectibles enables Ethereum-based NFT holders to create index funds based on blue-chip NFTs like CryptoPunks, BAYC, Axies and Cryptokitties. These funds are readily tradable on decentralised exchanges like Uniswap. Index Funds allow investors to diversify investments with an option for various assets. With NFT index funds, you can invest in Fractional NFTs and get yields. A group of investors can pool their funds into an NFT pool, gaining exposure to either an NFT such as CryptoPunks or a basket of assets. So rather than just buying a single NFT piece for hundreds of thousands of dollars, you can invest in a pool and gain exposure to yields by investing in NFT funds.

Different pools on NFT20.io

NFTs, a tool for social stratification

Moonbirds, Bored Ape, CryptoPunks etc., what comes to mind when you scroll through social media and see a handle with any of these NFTs as pfp? Rich! Think about it for a moment. The floor price of a singular Moonbirds NFT recently launched by PROOF is 37 ETH. That's over $110k. But that isn't all holders can extract from these blue-chip NFTs. Each Moonbird gives its holders exclusive benefits to join the Proof community (exclusive Discord group), where they do some heavy lifting, and mind-bending opportunities, as we have seen with past exclusive communities like the exclusive yacht party for BAYC holders. In addition, Moonbird holders will have access to PROOF’s upcoming metaverse "Project Highrise" in the future. As a holder, you also get to participate exclusively in 'Nesting', a form of staking for yields. Holders of Bored Ape, on the other hand, have full commercialisation access to their apes. Andy Nguyen spent $267,000 to purchase Bored Ape #6184, and he added two more Mutant Apes to receive access to the IP ownership rights and community granted to holders of the NFT. As a co-founder of Afters Ice Cream, Matte Black Coffee, Pig Pen Delicacy and more, Nguyen utilises his ownership rights to open the first Bored Ape Yacht restaurant dubbed "Bored and Hungry" in Long Island, California. Are you guessing those who might be the frequent guests in Andy’s Bored and Hungry restaurant? Fellow BAYC NFTs holders and other high-net-worth individuals looking to frolic and promote business engagements with the wealthy class could also frequent this restaurant.

Getting to the point where your NFT project becomes a sign of social status comes from building a solid community with a distinctive ethos. Take the case of the Meebits collection; even though a portion of it was airdropped to CryptoPunk holders, the rest quickly sold out almost instantly despite having minted above the average price. New holders of Meebits that bought into it aped in simply because it was associated with the OG CryptoPunk NFTs. Who wouldn’t want to rub shoulders with the high class? With such brand distinctiveness, NFTs are becoming a way for people with shared interests to connect and promote their goals.

How about owning a collection piece that your favourite celebrity also owns? I am a Cool Cats NFT holder; I’d feel special seeing one on Mike Tyson's Twitter profile picture. Being in the same community with the Iron Mike is always an experience I relish. Some NFT projects like Loot further create a community where NFT holders can bond. Now that’s some cool right there for those who cherish this social use case.

Deeper down the rabbit hole: NFTs in the Metaverse, DeFi, Gaming, Crowdfunding and Carbon Credits

While avatar-based NFTs (pfps) were the main drivers of the original NFT hype, it is essential to note that the NFT space has grown beyond digital art and has made its way into other industries.

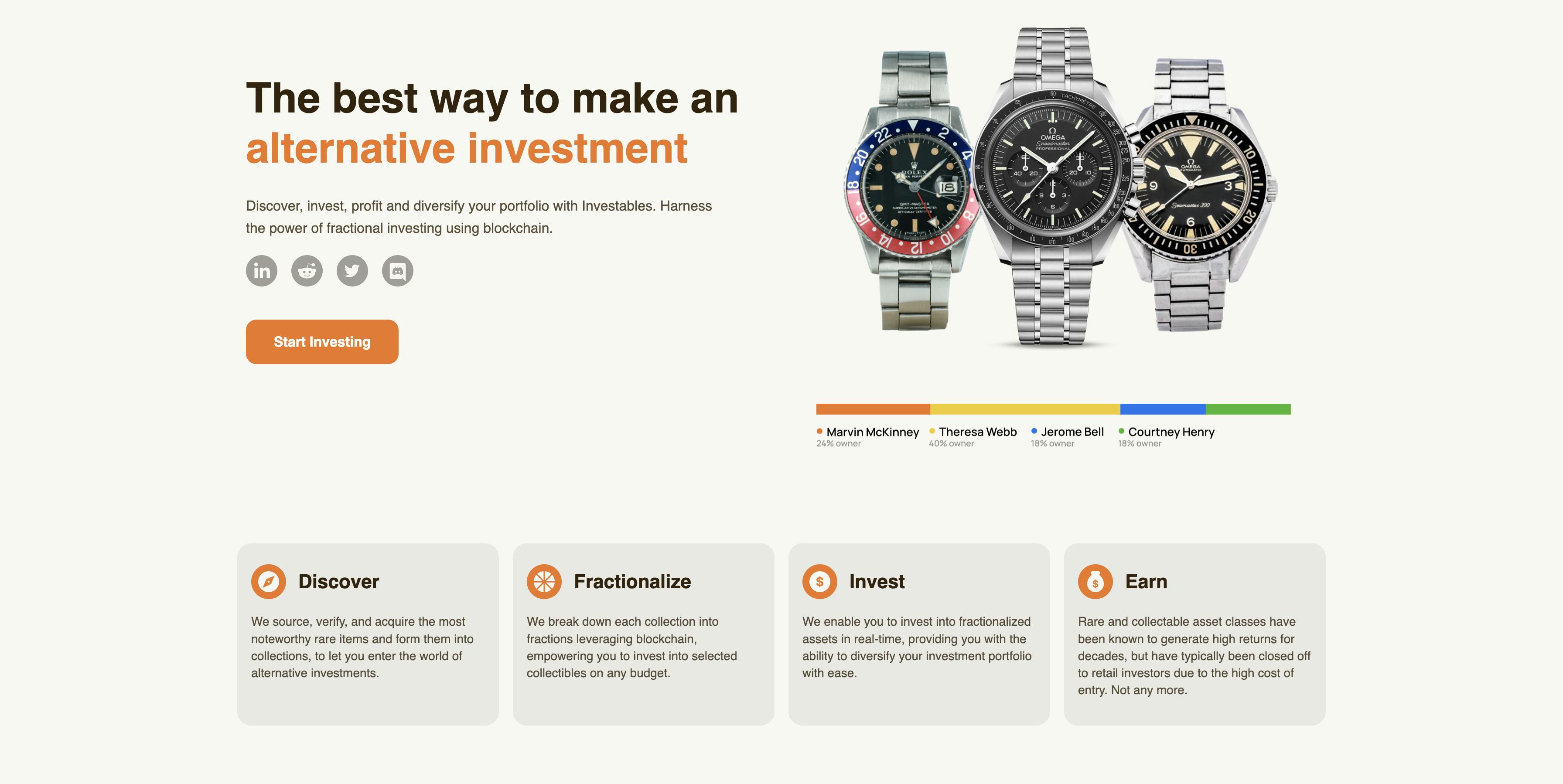

Collateralisation is a popular use case in DeFi lending and has found its way into NFTs. Holders can leverage their NFTs as artsets to borrow against a loan for yields. Due to the illiquid nature of most NFTs, unlocking an added utility in the form of collateralisation improves the sector even further and adds another use case for collectibles. Additionally, you can fractionalise the NFT for a smaller amount of loan if you don’t want to accumulate considerable debt. The concept behind fractional NFTs is that NFT owners can mint tokenised fractions of an NFT and share the ownership of the artset with others. To fractionalise a purchase on Ethereum, the NFT owner divides the ERC-721 token into multiple ERC-20 tokens. Hence, each ERC-20 token becomes a fractional NFT of the asset. Quite an interesting concept because most valuable assets like real estate are indivisible and require deep pockets to own or undertake as a project. F-NFTs solve this by allowing anyone to invest a small sum to gain fractional ownership of a high-priced asset. I find platforms such as Investables very handy here, even though it is just starting. Investables allow you to buy & sell equity shares in collectible assets or fractional NFTs from its platform. Holding Investables F-NFTs, anyone can own a high-value asset at a low cost. I expect this trend to continue growing in the coming years as more secondary markets emerge, allowing users to explore alternative investments, quickly liquidating parts of their NFTs whether gaming items, antique collections or pooling funds together to invest in pricy assets. Oh! I mean artsets.

Wait. We are not done yet. You can still do more with your NFTs in DeFi!

NFT staking and renting are two other new use cases increasingly gaining attention in DeFi. Some DeFi platforms now support staking options for NFTs. Platforms like Kira Network, Splinterlands, Only1, NFTX etc., allow NFT holders to stake their NFT artsets in their smart contracts and receive rewards. Play-to-earn games (GameFi) are currently leading the charge here. For example, in the Binance ecosystem, the play-to-earn game MOBOX allows players to stake their NFTs to earn rewards in its native token, MBOX. Staked NFT tokens can be used in governance and traded in secondary marketplaces. Alternatively, you can rent out your NFT assets by putting them up on NFT lending/borrowing platforms like reNFT. This allows others to borrow these NFTs for a specific period at a fee. Borrowers are usually required to deposit collateral to protect the owners. However, there are also non-collateralized NFT renting. The owner retains the original NFT while a wrapped version is minted and released to the borrower. With this wrapped version, holders would possess all the characteristics of the original NFT allowing the borrower to use it in equal capacity as the original. At the end of the contract, the wrapped NFT is burnt, and the original owner earns a renting fee. NFT renting is popular within the blockchain gaming ecosystem, where players can lend out their in-game NFTs for other players to use at a fee.

## NFTs in gaming

It's a popular use case for NFTs that it’s somewhat boring to write about. Don’t get me wrong, gaming and NFTs are like bread and butter. Unless you have been living under the rock, even if you've spent just a few moments within the crypto ecosystem, you've probably heard of Axie Infinity, the OG blockchain play-to-earn (P2P) game. The success of Axie Infinity is evident in the tremendous value and opportunity that NFTs offer. The chart-topping NFT-based game exploded in popularity during the 2020 Covid lockdown, aptly providing an alternative means for people to make a living while being stuck at home. On Axie Infinity, players can breed, trade and battle with minor NFT monster characters called Axies. Players can trade Axies for real money on the game’s marketplace and generate profit. Axie Infinity also has a virtual economy, and here players use two cryptocurrencies: SLP (or Smooth Love Potion) and AXS (or Axie Infinity Shard). Players also use these coins to purchase Axies, land, farms, etc. Currently, the game has a market capitalisation of nearly $3 billion, with over $4 billion in total NFT sales.

Following Axie Infinity's success, several other NFT-based games like Splinterlands, GodsUnchained etc., have emerged, offering users a wide range of opportunities to make a living by playing games. Furthermore, this trend is already making its way into traditional AAA games, albeit with some pushbacks. A recent example is Ubisoft’s implementation of its own NFT platform called Quartz, and Digits, its in-game NFT, amid backlash from fans in 2021. However, the platform remains operational and offers current players of its AAA game, Ghost Recon Breakpoint, NFTs of new cosmetic items, often back-dated to reward long time players. Turning these in-game items into NFTs allows players to claim sole ownership of items purchased and gives them the freedom to choose to trade, sell, or hold them. Hence, creating a direct means of monetisation in traditional AAA games. NFTs enable players to take ownership of in-game items out of the hands of a game’s publisher. Items bought and earned on an NFT blockchain can, in theory, be used across games. So if, for example, Ubisoft closes Ghost Recon Breakpoint but launches a new Tom Clancy shooter, you could, in theory, transfer your ‘Clancy NFTs’ to this new game. Many traditional game developers and experts have criticised this thinking of using in-game assets interoperable across different games, saying that it is fundamentally impossible from a technological standpoint. But hey! This is crypto. This whole space was considered "technologically impossible" barely a decade ago. It always seems impossible until it is done.

NFTs at the centre of the Metaverse

The transition to a fully digital economy has been underway for generations now. The hype around the Metaverse, an alternate digital universe that an average Joe may not even be able to define, is rapidly being developed in bits and pieces. NFTs will be the currency of the Metaverse. Early Metaverse projects like Decentraland and The Sandbox are already leading the charge here. Zuckerberg's Meta is making huge plays in the Metaverse space (I believe he’s ngmi, especially with the over the board 50% levy on creators’ works in the Horizon marketplace). What do these projects have in common? By facilitating an ecosystem VR, AR, and AI can interact within a blockchain governed world. Guess what makes this possible? NFTs! The Y2K race that swept through during the early 2000s saw a lot of brick and mortar imbibe companies' digital designs into their operations, but this time with NFTs. Brands are already racing to position themselves for this epochal moment. Top brands like Adidas and Nike have bought land plots in The Sandbox, a virtual real estate company. Move over to fashion brands, where NFT is banging hard, Gucci has teamed up with Roblox to sell items, and Balenciaga has partnered with Fortnite dev Epic Games to offer clothes that can be bought in virtual stores. Let me say it clearly; a burgeoning Metaverse economy will not be possible without NFTs!

In December last year, Nike acquired the virtual sneaker maker, RTFKT. And recently, the result of that partnership emerged with the release of Nike's first-ever NFT sneakers on Ethereum —the RTFKT x Nike Dunk Genesis CryptoKicks. The new Cryptokicks are NFT wearables designed for use in the Metaverse. Users can alter the characteristics of the sneakers using digital collectibles called "Skin Vials". Deploying NFTs in this manner can only strengthen the Nike brand and community. The community element of NFTs has become a fundamental value of common belief, creating various networking opportunities.

Interoperability among NFTs

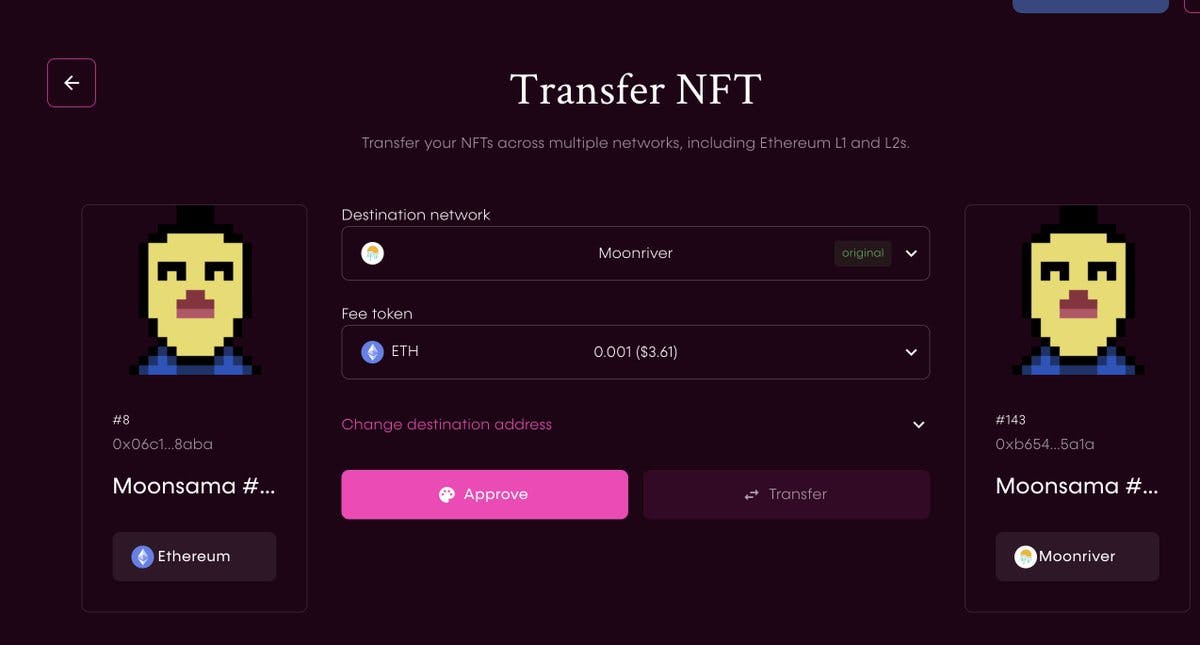

Sandbox, Decentraland and whatnot hosting digital real estate for brands and individuals to extend their digital existence needs more than just the siloed existence of each part to deliver a truly immersive and digital future. Interoperability for the Metaverse is a no brainer. This reality must happen even as innovators and brands build their digital extensions on several blockchains. And the siloed nature of blockchain ecosystems means that these several projects inherit the interoperability problem. Early Metaverse projects such as Decentraland and The Sandbox are built on the Ethereum blockchain. But others like Blocktopia, a decentralised gaming platform with NFT rewards and Portals, exist on Polygon and Solana. The problem here is that you cannot use Solana native NFTs on Ethereum and vice versa. DeFi interoperability is still an evolving landscape; hence directly impacts the development of all the sub-units (projects) to seamlessly connect to create a unified Metaverse with the immersive experience it has been touted to provide users. Composable Finance is a notable project building to make this a reality through its NFT transferal system, Mural. With Mural, the NFT community gets a transferal system wherein users can seamlessly transmit their artsets between various metaverse platforms. For instance, NFT holders can transfer their NFTs from the mainnnet to Polygon, Arbitrum or even native-Substrate chains like Moonriver or Picasso using Mural.

Cross-layer NFT transferral system —Mural

Cross-layer NFT transferral system —Mural

Kickstarter but with NFTs

Crowdfunding is not a new concept but using NFTs is new gameplay. More projects are turning to NFTs to raise funds seeing as the ICO bubble has popped and the increasing difficulty in bootstrapping liquidity for newly launched projects on DEXs. When you participate in a crowdfunding round, you get an NFT that allows the project to establish a direct relationship with you and other community members. An artist looking to bootstrap funds for a campaign or album can sell NFTs, which users can mint to grant them exclusive access to any future concert or show the artist organises. Beyond concerts and shows, an artist NFT of this sort could grant holders who are fans a close connection with the artist—closed session AMAs where your NFT is your gate pass to an exclusive Discord community. The artist can then offer private Q&A sessions amongst other things with their fans within the closed community. An example of an NFT crowdfunding platform is GameStarter, which enables independent developers to fund their games by offering pre-sale in-game items as NFTs. As a gamer, you can pick a different game, help fund it, and take ownership of a portion of the game.

Additionally, GameStarter has an on-platform marketplace and token ($GAME) to trade in-game item NFTs once the title launches. The system allows game developers to build a community before game releases and gives developers time to be creative. As a business owner, you could create an NFT for your business and then sell it on a marketplace for cryptocurrency. The transaction and all the data would be recorded on the blockchain. The exchange is simple: Your business gets the payment for the NFT, and your purchaser gets the NFT that they can further utilise for other functions.

Another interesting use case in NFT crowdfunding can be seen in events and ticketing. NFTs are being explored in the events industry to enhance artists’ and fans’ experiences. NFTs are introducing smart contracts where every investor in an event can get their cut automatically without involving intermediaries. For instance, say you want to attend a concert that goes for $50 or $100, the performing artist can get 40% of the ticket, the DJ pockets 15%, and the rest of the crew splits the remaining percentage. Also, fan NFT tickets can come with extra perks like allowing them to be redeemed in the venue for drinks, snacks, or even professional photography sessions.

Furthermore, since an NFT ticket is registered to each fan on the blockchain, a concert event promoter could use it as the vehicle for a rewards program that offers extra privileges to selected fans. This could mean granting access to a backstage party after the show, a meet-and-greet with a sports team after a game, or an event put on by the official fan club weeks after the event. And by eliminating intermediaries and unnecessary fees, event tickets will be significantly cheaper, thereby giving event organisers better control over ticket distribution. Companies like TicketMint and NuArca Labs have launched platforms to support NFT ticketing. Moreso, NFT tickets can carry value in ways paper tickets can’t, making them valuable even after the event. For instance, if you’re the sort that likes to hold onto concert or game tickets as memorabilia, you can hold onto your NFT in your crypto wallet. If it represents a memorable event, the NFT could even become worth something in the future.

Why would someone want to purchase an NFT from your small business?

A restaurant could sell an NFT as a ticket to get into a holiday party. If the ticket holder can't make it, they could resell it to someone else. Also, a new local cookie business could have a grand opening special where the first 100 people to buy an NFT would get a free cookie each week for a year. This creates cash flow for your business rapidly. What if you wanted to expand your business but didn't have the capital? You could sell NFTs, provide something in exchange for the holders and generate a cash infusion. This is why NFTs are the future of fundraising in businesses.

Carbon Credits metering and NFTs

This is another interesting use case for NFTs because of their uniqueness. Carbon credits rely on the concept of tokenisation to incentivize carbon offset production and emissions reduction. As carbon offsets are a unit of measure that certifies that a particular action project (crypto and mainstream) has removed one metric tonne of CO2 from the environment. The challenge with carbon credit metering has always been how to measure the offset unit accurately and that a specific action by a person/entity/project has offset some carbon credits. This is where the blockchain, more specifically NFTs, comes in. As NFTs are cryptographic proofs, NFTs solve the problem of double-counting credits. As derivatives, these tokenised carbon credits NFTs can be traded on blockchain-powered carbon exchanges like AirCarbon Exchange. Examples of exciting projects in this sphere include Moss, KlimaDAO, Toucan, SavePlanetEarth etc.

Change your life with NFTs

While NFT may seem like digital assets reserved for strictly degens alone, this may not be entirely true as they have use cases that spread to the physical world. For instance, non-degens can participate in NFTs through real estate, an aspect of investment that is familiar to them. NFTs can represent ownership of physical items or real estate through fractional ownership. Homeowners could sell part of their property to many small investors by issuing tokens on the blockchain. Investors could hold these tokens and receive a rental income, profit split on capital appreciation upon sale or both. Also, this could allow people to buy and sell fractional ownership in rental properties, potentially in a liquid market without a middle man. With fractional NFTs property investing will be open to many more people creating better options for those that need to unlock equity without borrowing or moving.

From all indications, NFTs cover a wide range that can change your life regardless of your knowledge in the field. I have detailed below how NFTs can be used in your daily life.

Fund your business - Leverage the power of NFTs in your businesses. Whether you're starting a new one or looking to expand an existing one, an NFT campaign could be used to raise funds, build excitement and elevate a business quickly. For example, create an NFT loyalty program that guarantees your product users a service at a later date and generates an immediate cash infusion.

Get your fair bargain - Time to stop giving your work out for pennies. If you are an artist or creator, eliminate gatekeepers and intermediaries by tokenising your work. Making NFTs of your work guarantees you get full compensation for what they're worth.

Create a community-based project - Communities are at the heart of every successful NFT project. You can create a social club, a value-based community or a transformational business by funding it with PFP NFTs. These NFT arts grant membership and give your community a sense of identity. The Bored Ape Yacht Club is one of the most powerful NFT brands built around a community.

Make gaming worth your time - If you're a gamer, you can seek out games that pay players for the value they bring by participating in the game. You don't have to play for just pleasure alone. The NFT-based, play-to-earn gaming model allows players to generate revenues from playing games. For example, gamers can spend up to $2000 per month playing Axie Infinity by trading in-game NFTs called Axies. Some other popular NFT-based games are Plant vs Undead, Gods Unchained, Decentraland, The Sandbox etc.

Safeguard your valuable assets - Create digital twin NFTs of your valuable assets. A digital twin NFT is a digital copy and record of ownership of physical assets that help eliminate counterfeiting. Notable brands such as LVMH, Prada, and Cartier partner with the NFT authentication platform, Aura, to tokenise ownership over luxury goods. Get in the habit of using authentication platforms like Aura and Nike's Cryptokicks to create tokenised versions of your physical assets.

Protect your medical data - You can own and monetise your medical data by converting it into an NFT. Aimedis, a hospital chain in the Metaverse, is building a platform that allows patients to protect and control their data through NFTs.

Monetise your leverage - Lastly, if you're good at anything but finding it difficult to monetise, NFTs present the opportunity to change that. With NFTs, the barrier to monetising and bringing your creative ideas to life has been lowered. There's currently very little that cannot be achieved with NFTs.

Blindsposts

By the way, by no means am I saying NFTs are the surefire silver bullet that solves all of the world’s current problems. The first is that NFT holders tend to conflate the extent of their digital rights. What you have is possession and, by extension, transferability. The artist who created the NFT still maintains ownership of the IP. NFTs, like any other thing, have their limitations. Even though they are unique identifiers living on the blockchain, NFTs still require maintenance like conventional arts. Let's make it clear, the image you see of the NFT isn't the NFT. Rather the NFT is the unique identifier that points you to the place where the NFT can been. That means your NFT is as good as gone if anyone moves the link or the server hosting the NFT image goes offline. Moreso, anyone with access to the server that houses it can equally alter the original art. Imagine clicking on the link to the BAYC #544 with ‘Solid Gold’ fur trait, which sold for 675 ETH, and instead, you get a meme mocking you because the servers hosting these images got compromised.

How about asserting provenance and authenticity per NFT as a creator or collector? The fact that mainnet (Ethereum) currently hosts most of the NFTs being minted doesn’t mean that’s the only place NFTs are burgeoning. Solana, Tezos, and Polygon are other chains where you can mint NFTs, and cheaper, for that matter. Yet, it was only until recently that OpenSea started supporting Solana-based NFTs. NFT marketplace Rarible, for example, offers the choice of three different blockchains when minting a token, so what happens when anyone who wants to buy and trade your NFTs cares about which of the three same NFTs on the different blockchains is authentic? The artist steps in to assert which with word of mouth? See, it’s a social problem even NFTs cannot solve. I kid you not!

Parting thoughts

So here's the thing: beyond the noise and hyper-financialisation of NFTs, the technology is gaining a foothold that offers anyone who cares enough to learn about their solid use cases. I understand some may not feel the need to key into the movement, still doesn’t change the fact that the NFT industry will keep evolving and getting better. Scams, rugpulls, Snafus, or even super celebrities like Kanye saying “Do not ask me to do a F** NFT” won’t slow the movement either. If people buy stocks with the underlying aim of speculating and later selling for profits, why not JPEGs as NFTs? After all, ownership of a company in the case of stocks or JPEGs (not all though) is based on an underlying asset.

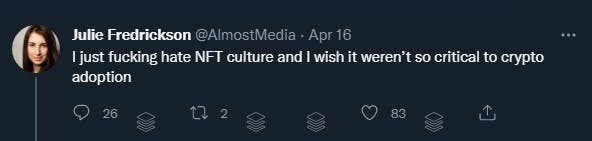

NFT index funds are only just getting started. And even if you say only speculations happen in this sector, as we see with the jpegs flying around, unlike in traditional art, in the case of NFTs, speculators are also collectors invariably helping to push for the broader goal —crypto adoption. It brings to mind the sayings of Colborn Bell, founder of the Museum of Crypto Art, who has over 2,000 NFTs in his collection. Bell is convinced, and shared that he collects crypto art goes back to the fact that he believes in cryptocurrency, a more superior and powerful technology than the current monetary system. Even those who can’t stand the hype culture around NFTs still recognise its pivotal role in accelerating crypto adoption to the mainstream.

Oh! If your business does not need to issue NFTs, don’t do it. It might be the death trap that eventually acclerates your downfall. Enough said, if you are building an NFT project, I’m happy to partner, offer my two cents (paid, of course), feature in your NFT or Metaverse focussed podcast, or even join you hands-on and build out that NFT project as long as our visions are aligned and we can vibe out. Don’t be shy; hit me up on LinkedIn.