Despite the meteoric rise of the DeFi sector within the last 24 months, it is easy to lose sight of the fact that DeFi still has large fish to fry before it can rival its global stock market counterpart worth at least $89.5 trillion as of April 2020.

The giant axes to grind appears to be the crippling charges pricing out retail users, liquidity fragmentation and the low throughput of legacy networks like Ethereum, a sincere cause of concern for institutional players to onboard into DeFi.

On that premise, Layer 2 (L2) infrastructures and EVM compatible chains like a black hole are sucking up all the attention it can get. Bridges that can connect and facilitate cross-communication of L2 and the slew of EVM compatible chains seem like the next big thing in the world of blockchains.

Dapps, dev tooling and even CeFi exchanges are onboarding in droves on L2 such as Polygon, Arbitrum, Optimism etc. Moreso, EVM compatible chains like Fantom, Avalanche C-chain, Binance Smart Chain etc.. are swirling in usage as well. The overarching aim is to help DeFi users and protocol developers alleviate the irks of DeFi 1.0 ranging from high transaction charges manifesting in the form of gas charges, mad slippages for AMM DEX traders and excruciating wait times for the DeFi nomads seeking alpha in the next “shiny” protocol release.

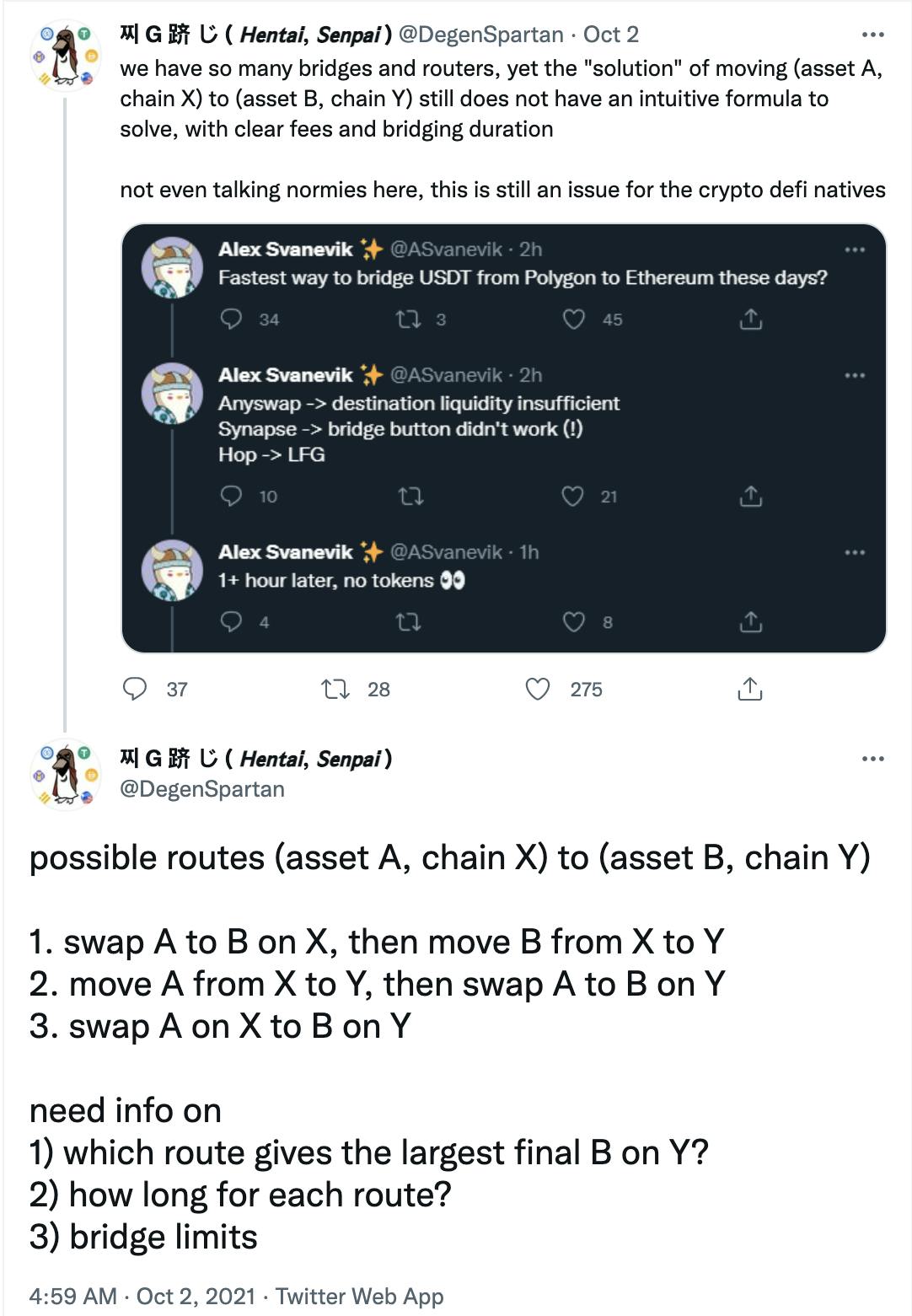

However, more Layer 1 & 2 options for users doesn’t mean the current DeFi problems are being alleviated. Take, for instance, the screenshot below; multiple bridges haven’t solved the problem for the DeFi natives. How then can a legacy financial user navigate the maze of swapping A to B on X and then moving B from X to Y as proposed by DegenSpartan?

The complicated bridges' ensuing effect is capital inefficiencies where locked crypto assets are underutilised save for just over-bloated TVLs, further liquidity fragmentation and the unending race to build the “next big thing for DeFi”, whatever that means.

So if newer bridges aren’t solving DeFi and the broader blockchain tech sector’s problem, what route should the industry adopt then? Just one word — Composability! Chris Dixon aptly captures this in one of his Twitter threads, while corroborating Naval Ravikant’s view that with composability rightly employed in DeFi, “every software component only needs to be written once, and can thereafter simply be reused.”

But, what if, instead (of building newer bridges and more layers), there was an infrastructure that allowed projects to build on each other and communicate near-instantaneously? This is the underlying hypothesis behind Composable Finance’s push for true interoperability in the DeFi space.

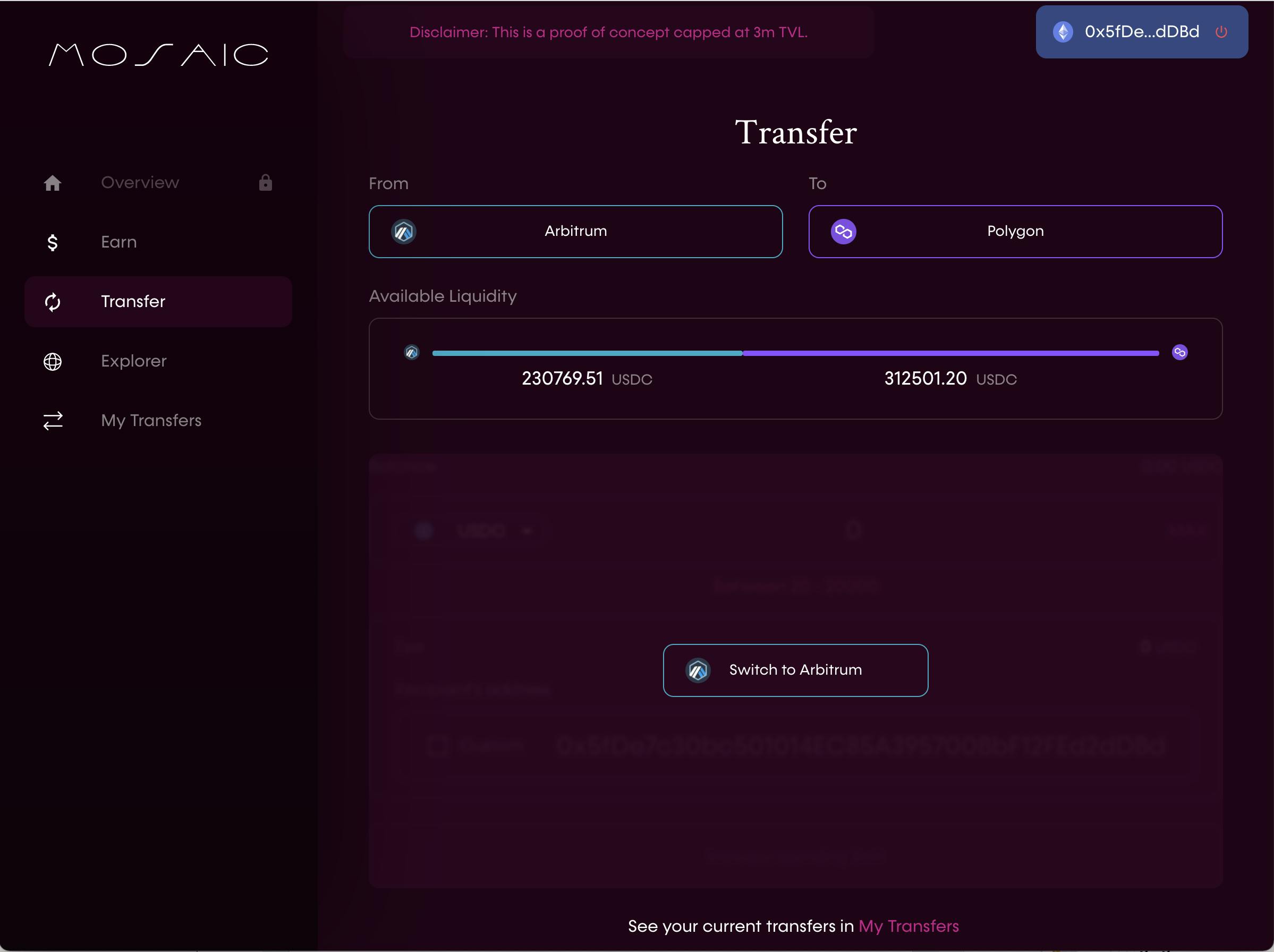

Composable’s vision is to enable different smart contracts (belonging to different Layer 1 & 2) to interoperate on the same Polkadot Parachain — Picasso, by pragmatically bridging between different layer 2 solutions without jumping multiple hoops ( Mosaic — layer 2-layer 2 transferal system already functions as a proof of concept).

Protocol developers can already utilize their Mosaic SDK which interfaces with liquidity monsters like Curve, Uniswap with a prospect for more bridge addition to spin off their own unique but highly composable dapps.

If there ever is a route to DeFi 2.0, then cross-chain and cross-layer interoperability meshed with composability is the sure-fire route to this DeFi Eldorado and Composable Finance appears to be supplying that single missing piece to DeFi’s most critical puzzle right now.