Evolution of DeFi governance

A comparison among inutility, veToken and ve(3,3) models

Only in crypto can a decentralised finance (DeFi) project launch and amass literally billions of dollars in total value locked (TVL) within a single day, and not many people will bat an eyelid. Most people we like to describe as “nocoiners”, dismiss DeFi as the arena where the biggest gladiatorial Ponzi maniacs play their ruthless game. The game of billions in the DeFi sector is most times determined by how “crafty” the development team behind any protocol they are with their token design. Mix and match economics with cryptography, and you get tokenomics. How does a newly launched algorithmic stablecoin looking to offer the DeFi with decentralised alternatives such as Terra’s UST, Abcradabra’s MIM or Frax Finance’s FRAX etc., as compared with the centralised USDC and USDT fair? Look no further, tokenomics covering the governance mechanisms of such projects will determine if that stablecoin will indeed capture significant TVL or bite the dust.

What are governance tokens?

Governance defines a framework of rules and procedures that regulates the conduct of all participants in a system. In blockchain systems, tokens play an essential role in distributing control among the community members. This is done using governance tokens in a process called on-chain governance. For instance, Polkadot enables binding on-chain governance where blockchains rules can be changed by its token holders who can run for the council and act in good faith of the network. On the other hand, token holders cannot directly change rules in off-chain governance, such as in Bitcoin.

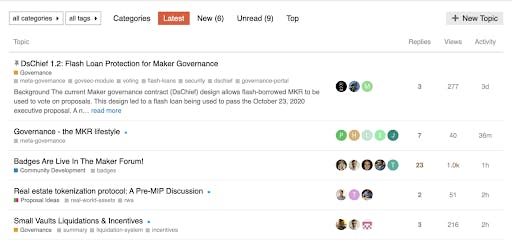

Decentralised finance (DeFi), a thriving sector of the crypto economy, has users participating in the decision-making process through governance tokens. Governance tokens holders can vote on decisions that influence a blockchain protocol, thereby determining the protocol's future through decentralised governance (dGov). To do this, holders create and vote on governance proposals covering new feature proposals, different fees, changing reward distributions, revising development funds, etc.

The role of governance tokens in DeFi

Governance tokens are used as change instruments in a protocol to uphold the blockchain’s core ethos, decentralisation. Below are a few ways governance tokens are employed in DeFi protocols.

Self-perpetuate and decision making

The structure of Maker (MKR), the governance token for Maker lending protocol, allows its holders to vote on decisions about its stablecoin, DAI. Equally, the COMP governance token plays a critical role in onboarding new assets and managing risk parameters. For Compound, token holders can vote on or create their proposals. E.g., suppose a code module is now defunct. In that case, core developers in the Compound protocol can’t just unilaterally remove such codes even though it may give access to malicious software to enter and game the system. Instead, COMP holders decide if the devs bring that up as a proposal. The power lies in the hands of COMP users to choose to remove or maintain the status quo. Also, if the base protocol in the code is hampering the blockchain’s ability to scale, the council can vote on a requirement to change the code.

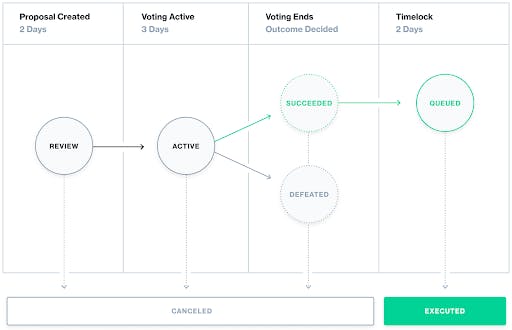

Restricted mutability

The multi-sig smart contracts of governance protocols adjust the dynamic parameters. Operators do this through token holders voting on protocol inflation schedules, assets listings, risk parameters for assets on money markets and trade fees for decentralised exchanges. When these parameters are adjusted, there is a time delay on voted-on changes, enabling those who disagree to give up tokens or exit the protocol.

Hence the time delay prevents administration, core developers or malicious actors from making any changes to these parameters without the community’s consent. That way, the protocol is only upgradable through the consensus of representative stakeholders without any room for arbitrarily upgrades of the logic of the smart contracts. To make changes, administrators have to pass through a timelock, which restricts the possibility of mutability.

Evolution of governance models in DeFi

The inutility model

In 2020, DeFi protocols such as Compound and Uniswap rose to prominence by issuing (through liquidity mining) tokens that gave holders governance rights on the protocols. This allowed protocols to bootstrap liquidity with attractive APYs. Liquidity providers (LPs) wasted no time dumping these governance tokens after the end of any liquidity rush program, resulting in the price dump of such tokens. The flaw became apparent; most dGov tokens had no direct economic benefits for holding them apart from speculation.

In SUSHI’s case, it doesn’t carry any direct governance powers or revenue-earning incentives. To earn fees from the DEX, holders have to stake their SUSHI for xSUSHI, a governance token representing a staked position on the Sushi platform and also acts as a fee-sharing token. To get xSUSHI, users have to stake SUSHI into the SushiBar for 6 months, and when xSUSHI is staked, holders get to earn a 0.05% reward fee of all dividends from all liquidity pools. Moreso, only a few early adopters to the protocol were fortunate enough to farm most of SUSHI tokens.

In Uniswap’s case, UNI’s utility is in direct governance. The downside to the UNI model is that while the Uniswap team claimed they would not participate in treasury decision-making, the team still controlled a larger portion of voting power in the early stages of governance. This mantra Sushiswap adopted, criticising Uniswap as a VC lackey and advocating a fair launch approach.

That era of inutility governance model simply produced poor token design. The need to incorporate ironclad utility into governance tokens beyond mere speculations and giving holders the right to direct cash flows while bolstering protocol revenue generation sustenance became a subject of heated debates.

The veToken model

The veToken model was a quantum leap improvement in the old governance tokenomics design. One protocol that popularised the veToken model was Curve. The low-slippage stablecoins DEX adopted the veCRV model to attract insane liquidity (Curve is the most liquid DEX in the DeFi sector). LPs who supplied liquidity any pool earned transactions fees for swaps supported by the pool. But that’s not all; the pool also incentivised LPs through emissions in the form of CRV tokens. Curve allowed LPs to then lock their CRV for veCRV (Vote Escrowed CRV), thereby reducing sell pressures from emissions. Now, this is where the genius of its tokenomics lie. LPs enjoy a dual incentive to lock up (stake) their CRV as it increases their returns per staking their LP tokens while also giving them passive income from all the pools on Curve through veCRV they get from locking their CRV between 1 - 4 years.

Hence, Curve’s veToken model reasonably solved the flaws of this inutility token design model by discouraging LPs from selling their tokens and incentivising LPs to make your token more liquid. But that is, of course, not all there is per the utility of veCRV. As a governance token, veCRV holders could participate in the governance decisions of the Curve DEX, ranging from boosted emissions into pools (gauge weight) to other protocol integration or even voting for proposals supporting the further development of a programming language we saw with the Vyper support proposal recently. Polkadot also did something similar through governance votes for Mozilla development support.

Moreso, the veToken model, aligns incentives across the different stakeholders in a protocol. For instance, DeFi protocols struggle to align incentives between token holders and liquidity providers. And because the two groups often have competing interests, if incentives are more inclined to token holders, the protocol risks losing liquidity and damaging the quality of their product. Also, if incentives such as fees are not directed back to the native token, the protocol risks upsetting and disengaging their core supporters. A balance is critical. The ve-model brings this balance by boosting token emissions for LPs who lock up their tokens in the protocol. And in doing so, it helps to align incentives between token holders and LPs by increasing the overlap between the two groups.

To summarise, this model is compelling because it improves on the shortfalls of the original inutility token model. In addition to improving the supply and demand dynamics of the inutility token model by giving token holders a direct cash flow benefit, the veToken model also encourages long-term oriented decision making.

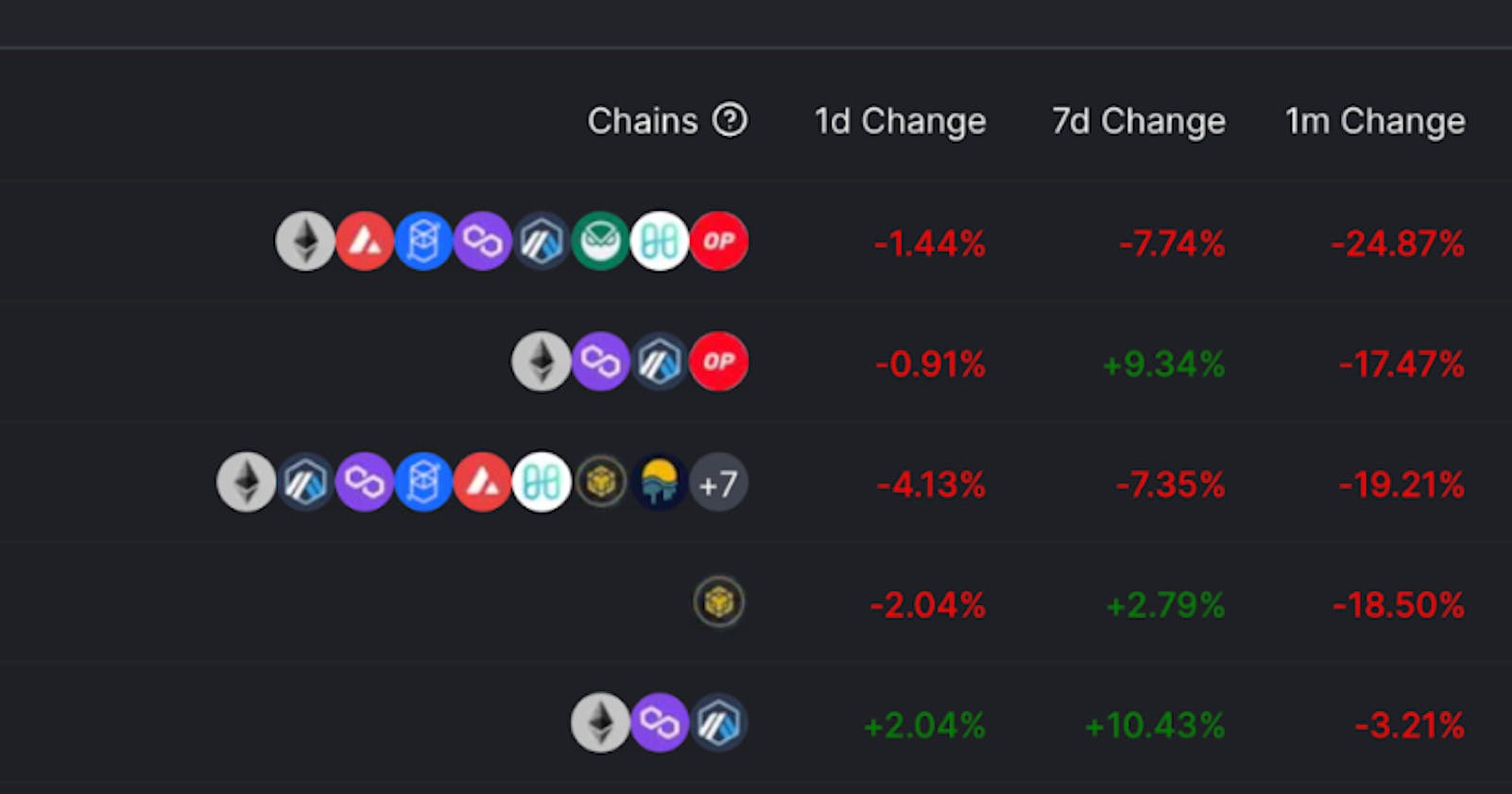

Curve wars

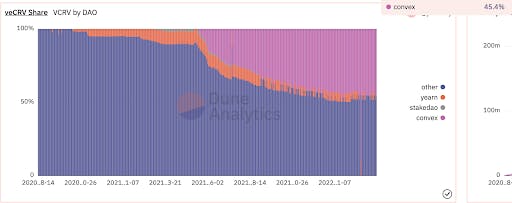

It is absolutely normal to see value accrue to a well thought out model like Curve’s veCRV tokenomics. As a protocol that supports other protocols looking to bootstrap liquidity for their tokens, projects have continued to accumulate veCRV to help direct liquidity to their tokens aggressively. It has become a case of accumulate or die so much that it is now described as the Curve wars.

Since accumulating liquidity is one of the main priorities of any DeFi protocol, the war revolved around users looking to maximise their incentive position on any Curve pool. They need to lock CRV equivalent for a non-transferable veCRV lock period of 4 years to get the coveted 2.5X APR boost. That is a lot for an average LP to cough out anytime.

Convex Finance, a leading Curve yield aggregator and the indisputable winner of the Curve wars, exploited LPs’ innate greed to maximise their APR on Curve’s pools, offering a rather easier way to get this. By simply pooling LP’s veCRV and deposits, stakers get the maximum APR without even needing to stake veCRV. This is how it works in a plain example: an LP looking to get the maximum reward rate for, let’s say $10,000 on Curve would need $12,000 in CRV tokens locked. However, by staking through Convex’s frontend, an LP can get nearly that same rate without depositing any veCRV plus some CVX (Convex’s native token). Sounds like a double whammy!

This is the iteration below:

Deposit CRV tokens into Convex to a liquid cvxCRV. Convex then stakes your CRV for veCRV, which doesn’t belong to LP but Convex. Since cvxCRV is liquid and transferable anytime without the usual maximum 4-year lock-up of veCRV, LPs can then stake their cvxCRV to earn a share of all the veCRV rewards Convex is earning (recall about 17%). Right now, the APR for depositing your CRV to stake cvxCRV is 54%, significantly higher than the 13% you get for just locking your CRV for veCRV. A lot of that comes from the CVX issued to CRV stakers as an incentive since this is the main way CVX gets issued to the ecosystem.

Like a chain reaction, Convex quickly amassed billions of CRV LP tokens (holds with this model while itself as a protocol was earning 17%), reaching 45.4% of all the veCRV tokens as of March 2022.

Recall veCRV tokens afford holders voting rights where they vote for emissions to be directed to the highest APY paying pool through the gauge. Essentially, gauge weights are like mythical money shooting gun that projects seeking CRV emissions into their pool have to get to vote every week. The higher weighting your gauge is through voting (by veCRV holders), the more CRV emissions are directed to your pool, and the more incentive for LPs providing liquidity into your pool, and the cycle continues. Convex and Yearn Finance fought crazy to attract the highest gauge weights, but Convex is King in the Curve wars.

Steering DeFi’s future and upcoming liquidity wars through improved dGov

It's safe to say that Convex has won the war already as it can almost unilaterally control which pool gets emissions per Curve’s pools. With contenders realising this, the “if you can’t beat them, join them” became the logical path to follow. Convex’s CVX tokens become the honey pot for projects to get enough if they need voting power for emissions into their pool. A new war emerged: Convex wars. Two ways to win this war: buy up all the CVX tokens you can in the open market or bribe CVX holders to vote for them, which is cheaper.

Bribery as a tool for influencing outcome in the Convex wars

DAOs are emerging to supplement this bribery process, but first, what is bribery in dGov? It is just a way of incentivising DAO token holders to govern. Per the CVX example, instead of spending heavily to purchase CVX tokens on exchanges that could further strain such projects' treasury in cases of price dump after proposals or general market crash, just bribe existing CVX holders. Pay them to govern. Voter power delegation platforms such as Tokemak, Redacted Cartel are all scheming out innovative ways to amass veCVX to put them at a vantage point in the ensuing Convex wars. For instance, Redacted allows CVX and CRV holders to bond their tokens and get BTRFLY for a discount.

Seeing the favouritism and all the back door deals in the Convex wars, another project, Bribe Protocol has created a platform like Votium, a secondary marketplace for trading voting powers. With its Voter Extractable Value (VEV) platform, governance token holders earn an income by leasing their voting power inherent in their governance tokens through auction. By staking dGov tokens in a Bribe pool, individuals or DAOs looking to influence the outcome of any governance proposal can borrow these tokens to support or reject a proposal. The advantage here is those governance token holders who stake in a Bribe pool still maintain ownership of their gov tokens while earning a share of the auction bid for the, which at the moment is still an evolving concept will continue to be relevant as long as the fight for liquidity (liquidity wars) exists in the DeFi arena and governance token holders are always the party to reap the most gains.

The future of dGov — ve(3,3)

Even with the cool advantages of the veToken model, there are obvious flaws. Andre Cronje outlined some of these flaws stating that the Curve model heavily focussed on and incentivised liquidity rather focusing on the pools that generated most fees through swaps. Even though Solidly DEX project didn’t live up to its hype, Cronje adopted the ve(3,3) tokenomics model that draws its extrapolation from the Nash Equilibrium. The ve(3,3) model combines the inflationary reward token of CRV and the staking mechanism of Olympus DAO’s (3,3) model. Curve’s token value is derived from its governance power when it is staked and locked up for an extended period to control emissions of future rewards (veCRV). On the other hand, Olympus DAO focuses on achieving the status of a store of value with its rebate token model by utilising staking as a primary source for accruing value to OHM. The ve(3,3) model proposes three key changes to veToken model. These are dynamic changes of emission level weekly, which will benefit veToken holders and the NFT application for the veToken locking process. Hence, the ve(3,3) model has a key differentiator:

- ve(3,3) prioritises fee-generating pools, ensuring that lockers will only receive fees for pools they voted for.

- Equally, in addition to rewards earned, lockers who bond their LP tokens receive vested NFT thereby reducing sell-off rate

This model helps prevent the possible hijack of a protocol, as we have seen with Convex basically controlling which protocols’ pools get emission or bite the dust. With the popularity of Olympus DAO and innovators looking for sustainable revenue-generation model for their protocols, it's only a matter of time before someone puts the ve(3,3) model to proper use and other protocols toeing the same path.